Below are my comments on the 2024 Budget. I encourage you to submit your own comments to the city clerk using the link below. If enough people speak up, even with just a one line comment saying "NO", collectively we can make a difference and persuade Council to send the budget back for reductions.

Growing Expenses

In 2011 the Mayor voted for his first budget. That budget contained total

expenses of $40,140,392. At that time Owen Soundís population was 21,688.

The latest financial information available to the public is contained in the

2022 Audited Financial Statements. These statements show that in the 11 years

following the first budget the Mayor approved, expenses grew to $59,753,592 while

Owen Soundís population reduced to 21,612. If approved the 2024 budget will

increase spending to $62 million. Thatís an increase of 55% in just 12

years. On average the budget has been growing by $1.8 million per year. If

approved the 2024 budget will increase spending by $2.2 million. Owen Soundís

spending is projected to reach $74.0 million by 2030 if spending

continues at the current rate and taxes will grow by 24.2% from their 2022 value. Owen Sound is the poorest community in Grey-Bruce

and residents cannot afford these annual tax increases.

Poor

Performance Comparisons

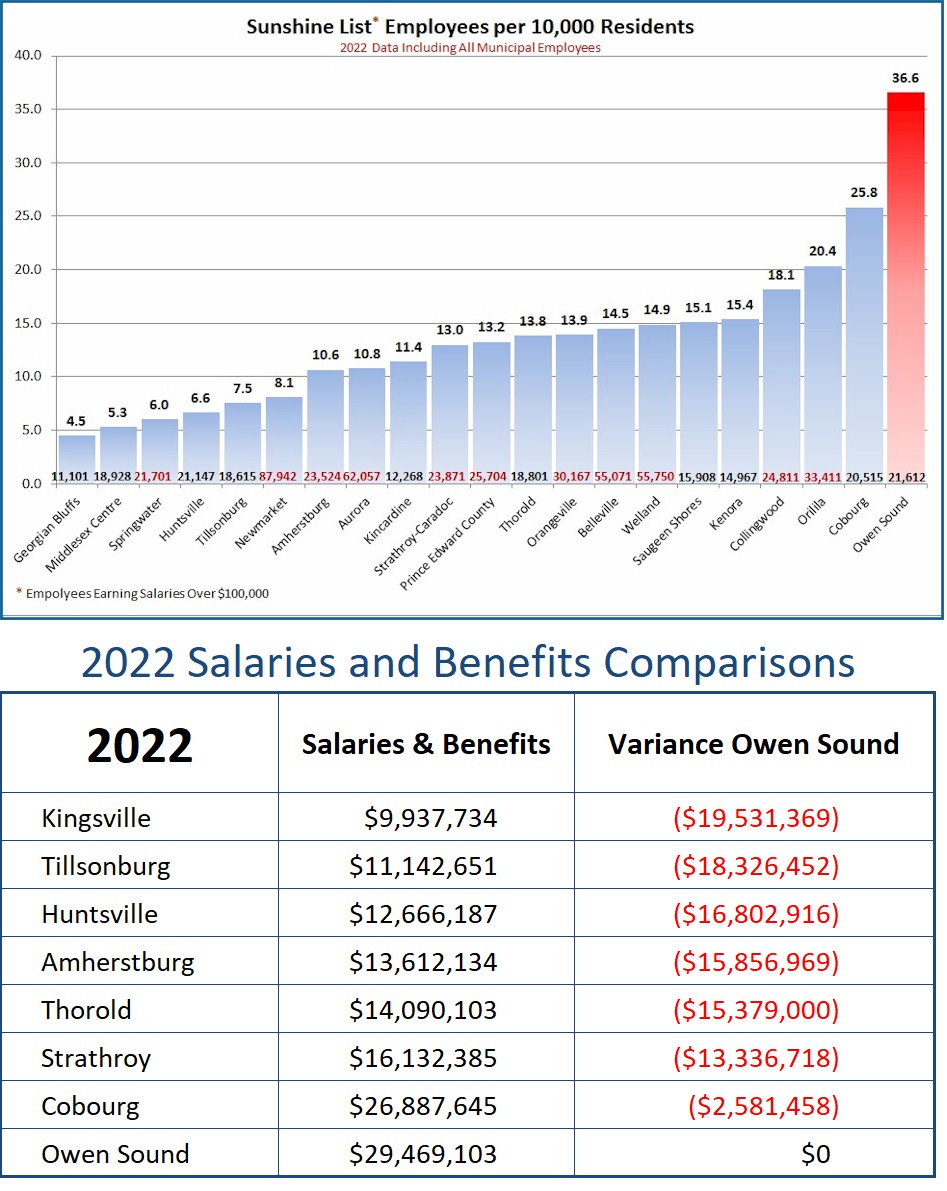

The Town of Cobourg is nearly identical to Owen Sound in population,

population-density, and in the number of occupied dwellings. In 2022 Owen Sound

had 79 employees earning over $100,000 while Cobourg had only 53.

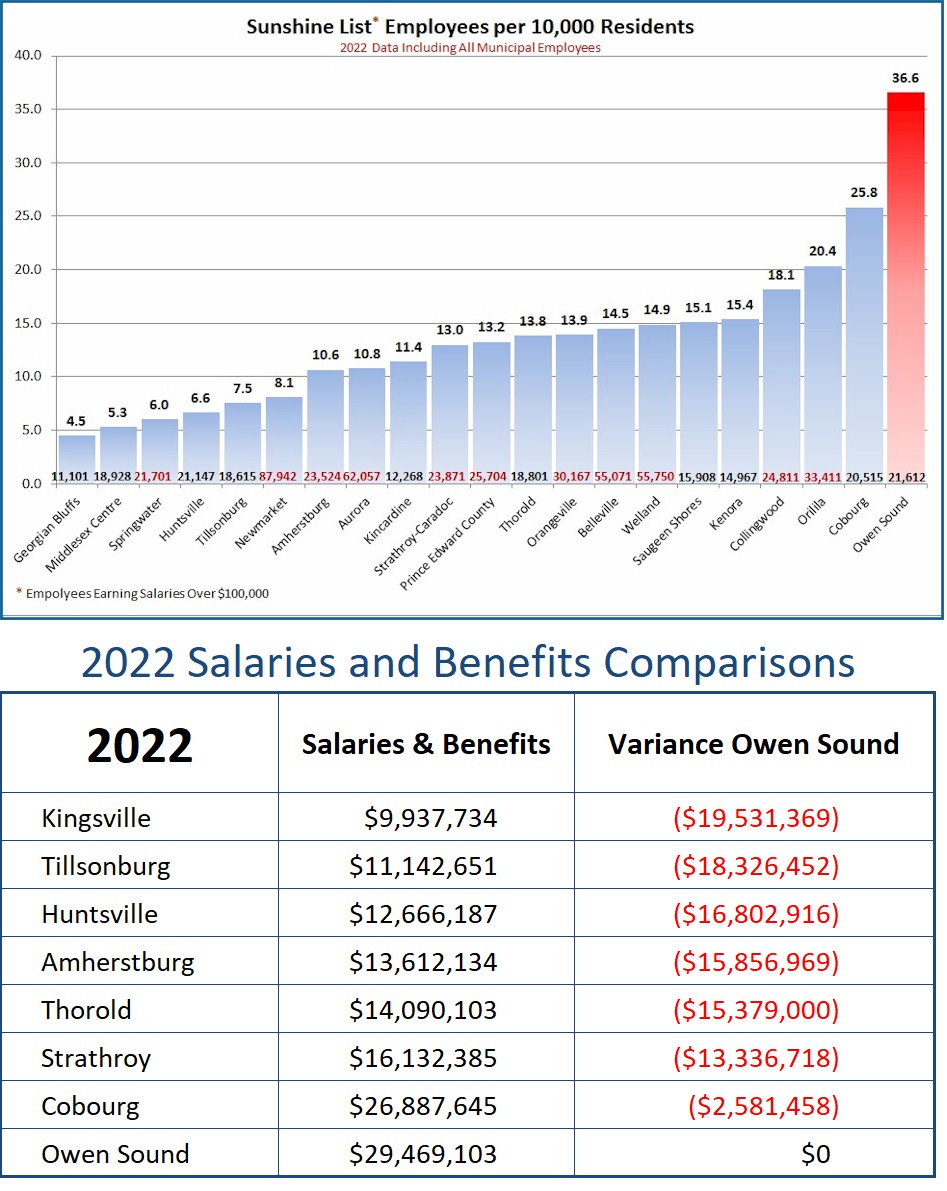

As well, Owen Sound collected $6.5 million more in taxes than Cobourg;

spent $2.6 million more than Cobourg on just Salaries and Benefits and

spent $4.9 million more than Cobourg to deliver nearly identical

services. Also of note was that in 2023 Owen Sound received $1,961,600 in

provincial grants while Cobourg received only $35,600. Although Owen Sound spent

$1.4 million more than Cobourg for winter maintenance, the provincial grants

more than make up this difference.

Cobourg was able to achieve this level of efficiency by fostering an entrepreneurial culture at City Hall that provides a welcoming environment for both businesses and residents. Cobourg, like Tillsonburg, has developed profit centers to reduce their dependency on tax revenue. Both of these municipalities get only 47% of their revenue from taxes while Owen Sound gets 51% of its revenue from taxation.

Someone might argue that they can find a similar municipality somewhere in Ontario that doesnít compare well to Owen Sound. Although I donít believe one exists, it really doesnít matter. The point is, that if Cobourg, a nearly identical municipality, can deliver similar services for $6.5 million less than Owen Sound, than Owen Sound is not performing as well as it could and it is up to members of council to correct this problem.

Absence

of Business Acumen

Consider that a municipality is really a service delivery business whose

leadership consists of an operational Board of Directors and a CEO who are

elected by shareholders every 4 years. Like any business a municipality competes

with others for new customers (residents & businesses) to relocate to their area

to enable them to purchase their services. In Owen Soundís case thereís been a

steady migration of customers to other municipalities over the past 25 years

because of the high price of services and Councilís failure to develop an

attractive environment for new residents and businesses to relocate to Owen

Sound. In other words as a business Owen Sound is underperforming.

We have members of council who manage businesses and Iím sure they will agree that no business could survive if it followed Owen Soundís lead of constantly raising prices without regard its customerís ability to pay or its competitorís pricing strategy. The Owen Sound administration is completely absent of any entrepreneurial spirit and fosters a traditional bureaucratic environment that addresses problems by hiring additional staff to help out instead of addressing the inefficiencies at the root of the problem. This would not happen in any Owen Sound business and if it did, that business would be bankrupt within a year.

It's Time For

Tough Decisions*

Owen Sound is the only

municipality of its size that has two Human Resource Managers, three managers in

the municipal clerkís office and is also the only municipality of its size to

employ a Senior Manager of Strategic Initiatives. The draft 2024 budget contains

two new part time positions which will have an ongoing annual cost of $104,000

per year.

In his end year address the Mayor commented on how busy everyone was and that staff had booked 200 hours in overtime. Could it be that we have too many staff attending meetings who really donít need to be there? We recently saw seven (7) members of staff attending a River District Meeting. They outnumbered the business owners. Could it be that staff are assigned activities that are not related to directly supporting the delivery of services? Or, to put it more succinctly, could it be that one of the reasons for historically high expenses is that staff are not being managed as efficiently as they would be if there was a measure of Business Acumen at city hall? Council needs to STOP trying to make excuses for the Out-of-Control expenses and STOP trying to downplay the magnitude of the disparity and START to implement solutions to resolve the high expenses.

| _______ |

|

.A Living Wage

Half of Owen Sound households take home less than $57,600. Assuming two wage

earners per household that works out to be about $18 per hour before taxes. The

2024 budget contains an increase to ensure all employees earn a living wage yet

Council appears to be fine with 50% of Owen Soundís population not earning a

living wage and is content with adding to their problems by approving another

tax increase. Council needs to show the same respect and consideration to Owen

Sound residents that it shows for city hall employees.

Fiduciary Obligation

The Municipal Act states that members of council have the responsibility

to ďRepresent the public and consider the well-being and interests of the

municipalityĒ. It is the responsibility of each member of council to ensure that

the city is being run as efficiently as possible. Right now, the facts show that

Owen Sound can and should do better.

When presented with irrefutable evidence that there are serious disparities when compared to similar municipalities, each member of council has the responsibility to take effective action to eliminate those disparities in accordance with the Municipal Act.

The bottom line is that Owen Sound city hall has room for improvement and Owen Sound residents cannot afford another tax increase. I urge each member of council to live up to their responsibilities and on behalf of the residents of Owen Sound send the budget back.

Here is a simple and easy recipe to begin the process of resolving Owen Soundís chronic spending problems.

A Simple Recipe for Success in 2024

Send the draft 2024 budget back for expense reductions sufficient to achieve a zero percent tax increase.

Prepare a new draft budget by fully implementing Zero-Based Budgeting

Include in the budget the estimated savings from donating our $30 million Art Collection to the County.

Include in the budget the estimated savings from cost sharing agreements for the Bayshore and Rec Center.

|

If you want to stop the staff-recommended tax increase send your

comments Email the Clerk and cc All Members of Council

Your comments must be received by |