Real Solutions to Solve Problems

|

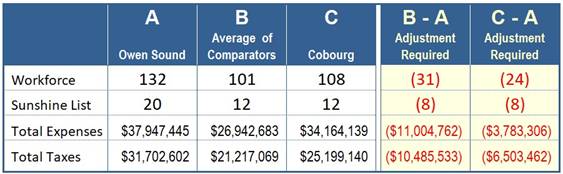

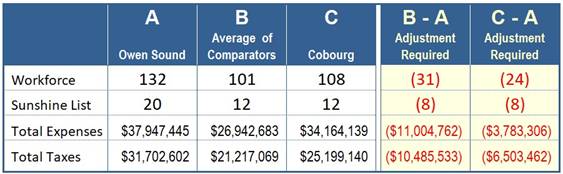

Owen Sound Taxes

are $10.5 million higher than the average of the three primary comparator

municipalities and $6.5 million higher than Cobourg which is nearly

identical to Owen Sound in population, population-density and the number of

occupied dwellings.

Owen Sound spends $11 million more on delivering services, not including

Protective Services, than the average of primary comparator municipalities

in the study group and $3.8 million more than the municipality of Cobourg

which delivers nearly identical services. Table 10, below shows the

magnitude of the challenge in bringing Owen Sound Expenses in line with

similar municipalities. |

|

|

|

Table 10;

Changes Required to Restore Municipal Administrative

Competiveness |

Owen Sound’s total expenses, including protective

services, have been growing at a rate of $1.3 million per year since

201142. In 2011 Owen Sound’s total expenses were $40.1 million and in

2022 they were at $55.3 million. During this time Owen Sound’s

population reduced by 76 residents. Therefore population was not the

driving force behind this astronomical expense growth.

There are four areas that Council should focus on:

A. Increase Non-Taxation or

Ancillary Revenue,

B. Share Costs with Others,

C. Reduce and Tighten Up Support Services

D. Re-Align, Re-Organize and Re-Think

A. Increasing

Ancillary Revenues

Owen Sound generates only 49.5% of revenue

from ancillary resources while Cobourg generates 56.1% of its revenue from

non-tax sources. Owen Sound can increase its non-tax revenue by doing the

following:

1) Ancillary Business Department

Create an Ancillary Business Department and

hire a Director, with business development experience, on a five (5) year

renewable contract, reporting to the City Manager. The initial mandate

should be to increase ancillary revenues by 10% or $3.1 million over the

initial contract period.

2) Develop Profit Centers

Municipal operations are traditionally

composed of a number of cost-centers that provide needed services to

taxpayers. As a result the culture within city hall has traditionally been

focused on providing the best services money can buy. Well-meaning city

staff routinely focus on improving services to the community and searching

for opportunities to enhance the quality of services. Typically reducing the

cost of service delivery is not a priority.

A surprising discovery, when examining municipal expenses, was that two of

the municipalities in the study group had established Profit Centers.

Surprisingly, municipal Profit Centers are not all that uncommon in Ontario.

Not too far from Owen Sound, just down highway 21, is Bruce Telecom which is

a public utility that is wholly owned by the Corporation of the Municipality

of Kincardine. Kinecardine just recently sold this Profit Center and by

doing so added $32 million to its municipal coffers.

The most interesting Profit Center in the study group is Cobourg’s

Industrial Complex. A number of years ago Cobourg’s Council approved an

investment in Cobourg’s vacant industrial property. The annual amortization

expense for this investment in 2021 was $721,875.This turned out to be a

good investment given that the annual net revenue from Cobourg’s Industrial

Property is $2.1 million.

Cobourg’s second Profit Center is its Marina business which is generating

$53,959 in annual net revenue. Tillisonburg found an innovative way of

leveraging its surplus assets by leasing them instead of selling them. For

Example the Elliott Fairbairn Centre is a facility located on Earle Street

in Tillsonburg. It is owned by the town and is leased to the Province of

Ontario for the training needs of the Ontario Provincial Police.

Owen Sound can emulate Cobourg’s success by creating similar non tax-based

revenue streams. Instead of disposing of city assets the city should invest

in these assets and turn them into new revenue sources. Like Cobourg had a

few years ago, Owen Sound has surplus industrial land that could be

developed by the city and provide the city with a steady flow of revenue in

perpetuity. Serious consideration should be given to following Cobourg’s

success with its industrial park initiative by investing in city owned

industrial property.

There are similar opportunities

for developing profit centers in Owen Sound. For example, all surplus

assets, such as an unused building, should be offered for a long term lease,

instead of offering it for sale. Such action eliminates the potential

business’ need for capital to purchase the building and frees up resources

for investing in leasehold improvements. Leases for 15 to 25 year periods

should be offered, with options to renew. This would potential leaseholders

the opportunity to make sizable investments in leasehold improvements that

could be amortized over the lease period. This strategy will give the city

steady revenue for the life of the building in question

3)

Engage Staff and Encourage a Business Approach

In order to recognize revenue generation and cost saving opportunities staff

needs to adopt a ‘business approach’ as opposed to a, ‘municipal

administration approach’ when interfacing with city assets. This will

require a combination of education and incentives to change the culture.

One method of encouraging an ’entrepreneurial spirit’ in a municipal

environment is to establish a business-focused, Suggestion Awards Program.

The program should be open to both city staff and the general public and

reward successful ideas with the first two years net profits of the new

business venture. In the event of cost-saving suggestions the employee or

resident who made the suggestion should be awarded the net cost savings, up

to a maximum amount for each successful suggestion.

If implemented such a suggestion award program will encourage staff to think

differently and gradually change the culture at city hall. An example of the

type of thinking that should be encouraged is the idea I put forward last

year to reduce the cost of Transit. The idea involved improving ridership by

increasing peak-time service and reducing costs by partnering with local

school boards to reduce their student bussing costs.54

How to Fix Our Broken

Transit System

I’m sure that front line staff see inefficiencies in some areas of service

and have ideas on how to improve things. They just need to be encouraged to

put their ideas forward and providing a monetary reward for successful ideas

may be all it takes to begin the process of ‘Thinking Differently’.

B.

Share Costs with Others

1)

Cost Sharing Agreements for Recreation Facilities

Owen Sound residents have by far the lowest ability to pay high taxes yet

they are burdened with the full cost of providing services that many

residents living adjacent municipalities use on a regular basis. Neither

Georgian Bluffs nor Meaford residents contribute anything, beyond their user

fees, toward the maintenance of these regional facilities such as the

Bayshore, the Rec Centre and the Art Gallery.

Owen Sound has a population of 21,612 residents and occupies only 24 km2 but

is surrounded by Georgian Bluffs and Meaford which have a combined

population of about 22,585 and cover an area of 1,187 km2. Therefore it’s

understandable that residents of both Meaford and Georgian Bluffs would take

full advantage of Owen Sound’s attractions and recreation venues. The number

of Owen Sound residents filing income taxes on between 2018 and 2019 reduced

by 2.2% according to Statistics Canada 41. In all likelihood, wage earners

are just moving across municipal boundaries to reduce one of the growing

strains on their family finances – high Taxes and the high rents that result

from high taxes. After all, they can continue to enjoy everything that Owen

Sound has to offer, while living in Georgian Bluffs or just East of 28th

avenue in Meaford.

Given their relative populations, Owen Sound should only be paying for 48.9%

of the total cost of regional services, Georgian Bluffs and Meaford should

cover 25.2% and 25.9% of the cost respectively, including amortization

expense.

It was recently brought to my

attention that Owen Sound attempted to negotiate a cost sharing agreement

with Georgian Bluffs 10 years ago and failed. Given this I would recommend a

different approach. My approach would be to start this budget season by

publicly giving them notice that effective January 2025 neither the Rec

Center nor the Bayshore will be providing subsidized services to

non-residents due to current economic conditions. This will either prompt

them to open negotiations or not. Either way it will be a win for Owen

Sound. If they come to the table our position should be that Georgian Bluffs

and Meaford cover 25.2% and 25.9% of net costs respectively. If they don’t

open negotiations it will open new opportunities for these facilities.

As well as preserving existing

commercial contracts, this approach would allow for expanding commercial

services and ancillary uses at competitive rates, e.g. the Rec Center could

contract with a 3rd party fo r the bulk purchase of ice time etc. at market

value. If it comes to losing non-residents participation in programs, it

should not hurt the business. It could actually help the business by opening

new opportunities. This is where the Director of Ancillary Services comes in

to grow the business while protecting the original intent of the recreation

facilities to provide services to Owen Sound residents at a fair ticket

price.

One thing to keep in mind is

that these facilities do not exist to provide services to non-residents and

the status quo of Owen Sound taxpayers subsidizing recreation for

non-residents must end. Either way the potential reduction in expenses is

$1,981,452 x 0.511 or

$1,012,521.

2) Donate the Art Gallery Collection to the County

|

|

|

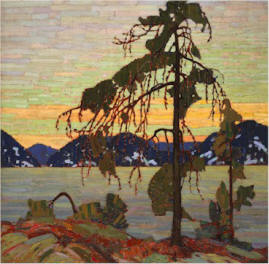

The Jack Pine by Tom Thomson |

The Art Collection that is

currently under the control of Owen Sound was acquired from regional artists

and donors. It is therefore only fitting that the regional government take

possession of the collection and manage it on behalf of all County

residents.

The results of the last

community survey show that less than 8% of Owen Sound residents regularly

visit the Art Gallery. Hence, there will likely be little or no support

among Meaford or Georgian Bluffs taxpayers to share the cost of this

regional service. Therefore the only solution available to share the cost of

this service is to donate the collection to the County for control and

maintenance. This would better reflect the regional nature of the Collection

and would actually be more appropriate than it being exclusively under Owen

Sound’s control.

The same arguments used to justify uploading the Disability Committee to the

County apply in the case. The County already provides the region with a

cultural attraction in the Grey Roots Museum and Archives. So, adding the

Tom Thomson Art Gallery would centralize the Region’s cultural assets in a

single location. This would also better reflect the regional nature of the

Collection and the artists who contributed to it. Therefore, the County’s

stewardship of the Art Gallery would actually be more appropriate than it

being exclusively under Owen Sound control.

The current building housing the Tom Thomson Art Gallery could be offered

for lease to a new or existing business and thereby establishing Owen

Sound’s first Profit Center. I believe that this compromise solution is a

better option then what many are advocating which is to close the Art

Gallery and sell the collection so the proceeds could be used to reduce

taxes. From an Owen Sound taxpayer perspective it would reduce net expenses

by as much as $500,000 once the building lease revenue is considered. This

would represent a 1.6% reduction in taxes.

3) Expand Administrative Shared Services

Owen Sound is not maximizing the use of shared services with adjacent

municipalities to reduce the cost of administrative support.

Almost all Ontario municipalities share some services to some degree. There

is an excellent paper on this subject that I highly recommend. It is

authored by Zachary Spicer Institute on Municipal Finance & Governance and

published by the University of Toronto,

Linking Regions, Linking Functions:

Inter-Municipal Agreements in Ontario 53

|

|

Inter-municipal agreements are a growing part of

the governance landscape in Ontario's municipal sector. Past

research - mainly American - has shown that inter-local

agreements can overcome institutional deficiencies in

metropolitan governance and better provide for policy and

service Continuity ...

Zachary Spicer |

In this regard Owen Sound has a number of administrative services that can

be easily shared with the other Ontario municipalities either using a

portion of the existing employees from each of the municipalities or

contracting to the third party provider. Some good candidates for shared

services are Information Technology, Accounting and Payroll but there are

several others. High Speed Internet makes it possible for Owen Sound to

share services with any Ontario municipality. Therefore Owen Sound should

look beyond the Region to identify potential municipal partners.

C. Reduce - Tighten the Support Services Group

1)

Examine the Organization for Redundant Services

Before reaching out to other municipalities to share services, Owen Sound

needs to first examine its workforce to identify and eliminate the

duplication of services. For example, Owen Sound has two IT Managers and two

Corporate Services Managers. One IT Manager (Mark Giberson) and one

Corporate Services Manager(Bradey Carbert) report to the Director of

Corporate Services; while, one IT Manager (Christopher Hill) and one

Corporate Services Manager (Suzanne Bell-Matheson) report to the Chief of

Police. It just doesn’t make sense to have two separate Information

Technology Departments. All of Owen Sound’s Information Technology services

should be centrally managed. It may be convenient for Police Services to

have their own IT department but Owen Sound Taxpayers cannot afford to fund

the luxury of such redundant services. The fact that Police Services reports

to the Police Services Board and not the City Manager makes no difference

when it comes to administrative support services since all positions are

funded by the same global city budget. Council needs to direct that all

administrative support services, such as IT are centrally provided. We

cannot afford individual departments, including Police and Fire Services,

operating in silos and providing their own administrative support services

such as IT, HR and Corporate Services.

2) Investigate the Outsourcing of Some Support Services

An alternative solution to sharing selective support services with other

municipalities is contracting out services. For example, just as some

municipalities have chosen to outsource their Police Services, selective

support services such as Information Technology, Human Resources and Payroll

can also be outsourced. council should explore the possibilities.

3)

Right Size the Workforce

Owen Sound city hall is

grossly overstaffed, which contributes to a large

part of this problem. When we compared senior management salaries, using the

Sunshine List, we concluded that Owen Sound is overstaffed by as many as

8

managers. In regard to Salaries & Benefits expense Owen Sound

spends $3.9 million more than the average of the three primary comparators

and $1.5 million more than Cobourg.

The positions involved can be readily identified by comparing Owen

Sound’s staffing to that of Cobourg’s and involve a unnecessary level of

middle management positions. In attempting to rebut the MNP report stating

that a few management positions should be deleted, the city manager gave us

some insight into the root of the problem. He stated that some managers were

“Managers of Process” which was why they had no direct reports. In the real

world if you have a process in your organization that requires a person with

a six-figure salary to babysit it, then you need to reorganize to change or

eliminate the process.

One example of redundant middle

management is Corporate Services. There is a Director of Corporate Services

and Treasurer, a Manager of Corporate Services and a Deputy Treasurer. The

City Clerk’s Office, IT and HR are all overstaffed by at least one manager

in the comparison with Cobourg and the City Manager’s office is over staffed

by two managers, Senior Manager Strategic Initiatives and Manager Community

Development & Marketing. That’s a total 6 additional management positions in

these two departments alone as compared to Cobourg.

Overstaffing developed incrementally over a long period of time. It nearly

always involved what appeared to be reasonable requests supported by

persuasive arguments of the need. For example, we are conscious about

climate change, so, of course we need to create a new climate change

position. We create a new Short Term Rental (STR) program, so, of course we

need to create a new position to manage the program. Owen Sound is the only

municipality that does this. Other, ‘cost- conscious’, municipalities build

in climate change initiatives into the coalface by educating front line

staff and add new requirements, such as the STR program, to existing staff

by prioritizing their activities. The total overstaffing, including these

management positions is in the order of 25 to 31 positions in comparison

with the other municipalities in the study group.

We saw the city disband Accessibility Advisory Committee, which reduced

staff workload to some degree, yet there was no staff proposal to delete a

position. A high performing business would have simply transferred the

person hours saved by no longer needing to support the Accessibility

Advisory Committee to cover the new workload created by the Short-Term

Rental bylaw.

We saw a similar example some time ago as well when the Human Resources

manager became swamped by a large volume of firefighter grievances. This

temporary workload challenge was addressed by creating a second Human

Resources manager position. This was certainly not the most cost-effective

way of dealing with this problem. This decision by senior management to

solve this problem by hiring a second HR Manager gives us some insight into

how management’s priorities.

|

|

Overstaffing at city hall is almost entirely the result of a

part-time council’s inability to effectively challenge municipal

staff’s natural propensity to grow their numbers. No business

could survive if they grew their workforce at a similar rate

without first growing sales. |

If Owen Sound were to match the average of the three primary comparators we

would need to reduce the workforce by 31 employees which would result in a

reduction of $3.9 million in Salaries & Benefits expense. If we were to just

match Cobourg’s workforce we would have to reduce Owen Sound’s workforce by

24 employees; which would result in a reduction in Salaries & Benefits

expense of $1.5 million. This translates into a reduction in taxes of

approximately 4.7%.

D.

Re-Organize, Re-Align and Re-Think

1)

Realign the Organizational Structure

Municipal governments exist largely for one reason – to provide services to

its residents at a cost the population can afford. Those involved in the

direct delivery of those services, such as the road maintainers, the Parks

and Recreation workers, etc., are part of the municipality’s core business

of delivering services to residents.

Those supporting those working in the core business, such as Finance, HR, IT

and Admin, perform an important supporting role. If these roles get

intertwined or confused, inefficiencies can develop. The MNP Consultant

observed organizational problems that created functional inefficiencies and

recommended changes.

This study identified similar inefficiencies and redundancies that need to

be addressed through changes and adjustments to the organizational

structure. For example in all other municipalities the Clerk and HR both

report to the CAO (city manager) and are both staffed at 60% of Owen Sound’s

current level of staffing. We also saw in figure 27, that there was a

migration of positions from the core business to administration. We saw that

the Administration grew from 26 positions in 2006 to 83 positions in 2021.

The impact of this migration is that there are fewer core business positions

dedicated to delivering services and more positions in Administration

supporting those delivering the services. This creates serious

inefficiencies in that it shifts resources away from the core business and

gives them to the administrative support environment, i.e. fewer people

doing the work and more people performing a supporting role.

We were also able to identify

two duplicate support services in the Police Services Department; an

Information Technology Manager and a Corporate Services Manager. This

workload needs to be assigned to the Director of Corporate Services and

these positions deleted.

2)

Introduce Zero Based Budgeting

In

management accounting, when a budget is prepared from scratch with its base

as zero, it is called Zero-Based Budgeting (ZBB). It promises to move

organizations away from incremental budgeting, where last year’s budget is

the starting point for the next. Instead, the starting point becomes zero,

with the implication that past patterns of spending are no longer taken as a

given. Essentially it is a method of budgeting in which all expenses must be

justified for each new period.

During the traditional budgeting

process, managers often view it as a bit of a contest to ensure their

department has the largest budget possible, as this is often seen as a sign

of the importance of their area. Zero-based budgeting forces managers to

understand the cash flows and expenditures of their department and to be

able to articulate why their department should be funded to a particular

level in the context of the organization's goals and objectives.

|

Zero-based

budgeting is a concept where the budget for the next budgeting cycle

for an organization, starts from a zero base as opposed to an

increase of the current spending levels. Under this process, the

budget amount for a department must be justified both in terms of

the purpose of the budget and the amount to be included in the

budget. . Roger

Wohlner |

In addition Council should develop a policy

directing that any budget increase from the previous year be accompanied with an

offset from another area. As well, any changes made cannot have an adverse impact on the

delivery or quality of services.

3)

Rethink the Size of the Economic Development Spend

Owen Sound continues to waste valuable resources on development in spite the

fact that these resources have not produced any measurable results in 20

years.

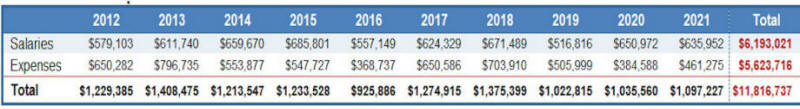

All municipalities invest in Economic Development in hopes of increasing

their improving their tax base and increasing their population. Table 11,

above provides some insight into the annual cost of Owen Sound’s investment

in Economic Development. As you can see Owen Sound has spent almost $12

million over the past ten years aimed at stimulating economic development.

This was NOT the best use of these tax dollars given that the city

population and tax base did not change during this period.

Owen Sound hasn’t grown in 30 years and in spite of the Mayor’s efforts over

the last 12 years it hasn’t happened yet. Hence there is a built up thirst

for Owen Sound to grow; which in turn encourages continued investment in

economic development. This has created a false optimism that growth is just

around the corner. I recall the Mayor saying many times over the last ten

years or so that: “We just need to grow the tax base”. He’s right! We would

all like new industry to relocate to Owen Sound and bring with it a host of

new residents to support our local business. However, based on the past 30

years, it is just unrealistic to continue to believe each budget year this

is the year that growth is going to happen. The reality is that Owen Sound

is not on the threshold of growth.

|

It’s time to face reality – it’s not going to happen. So stop Investing in

Growth! We wasted $12 million that could have been used to address other

worthy causes. We need to reallocate these resources toward more realizable

goals.

Based on past results I predict the only growth we are going to see when the

next census is published in 2026 is a modest increase in population in the

range of 1 to 2 percent which will bring Owen Sound’s population to about

22,000. This growth will be independent of Owen Sound’s spending on economic

development efforts. A preponderance of this growth will be due to seniors

relocating here from the GTA to take advantage of the relatively lower

property values and the quieter, safer, environment that Owen Sound has to

offer retirees. We only need to look at the price of new homes in Owen Sound

which are priced at over a million dollars. With a median after tax

household income in Owen Sound of only $57,600, very few locals can afford

these homes yet there is a steady sale of these million dollar homes.

It’s important to note that although all municipalities invest in Economic

Development, Owen Sound is the only municipality in the study group spending

over a million dollars annually on economic development. Owen Sound is also

the only municipality in the study group whose population has not grown in

over 30 years. Perhaps it’s time to rethink this expenditure.

4)

Change the Council-Staff Dynamic

|

I believe that the City Manager’s action in withholding

the consultant’s report from Council so it could be massaged and

“interpreted” by staff was clearly outside the role of a Chief Administrator

that is outline in the Municipal Act and summarized in an Ontario Government

Paper titled; “Role of council, councilor and staff”.23 The fact the city

manager felt so confident in his relationship with Council that he would

tell members of council that he was holding back a report on a study that

was marketed as being “independent”, so staff could “interpret” it, gives us

some insight into his perception of the relationship. This caused some to

question, who was really in charge at city hall. This exemplifies one of the

pitfalls of a part time council. That is there is often an unhealthy

dependence on staff for guidance to the extent that the level of trust

becomes so strong that it causes members of council to routinely accept

staff proposals as direction as opposed to suggestions. This is a recipe for

disaster, or in our case it’s a recipe for wildly growing expenses that are

not in line with similar municipalities.

I believe that a major

contributing factor in the gross disparities between Owen Sound and both the

municipalities in the study group and Grey/Bruce County municipalities is

the interface between members of council and the senior staff. It is highly

probable that there are conflicting goals at play and senior staff have been

the victors over the years as evidenced by the growth in Administration and

the growth expenses.

To avoid this staff should not

be allowed to present argument in favour of their proposal once a motion has

been tabled. Prior to this staff, after presenting their proposal, should

only speak in response to a question directed specifically to them as per

section 115 of the Procedural Bylaw.

5) Replace “Staff Recommendations” with “Staff Option

Analysis”

The current

practice is for staff to develop their preferred way ahead to solve issues

facing the city in the form of Staff Recommendations. The City Manager

allocates an enormous level of staff time to produce powerful presentations

aim at persuading Committee members and/or Council on their solution of

choice. These are often seen by the public as “sales pitches” and have been

very effective in influencing the way ahead on the issues. Historically

staff recommendations are adopted 90% of the time with no or only minor

modification. I believe that it is this practice that has resulted in the

gross disparities with other municipalities that have development over the

years. At the very least this practice gives the perception that it is the

staff at city hall are the actual decision makers and not our elected

officials.

As outlined above

public sector managers sometimes have their own informal organizational

goals that are often in conflict with the organization’s formal leadership.

Whether or not this is the case at our city hall, it needs to be changed to

avoid the perception that city staff is inappropriately influencing Council

decisions. Therefore the practice of staff presenting “Staff

Recommendations” should end. Instead, staff should identify all realizable

options and complete a comprehensive option analysis. Then staff should

objectively present their findings to the Committee and/or Council without

identifying or hinting at their preferred option.

The fact that

staff has had the time to produce these sales documents in the past,

supports the finding that Owen Sound city hall is overstaffed. For example,

it was clear that hundreds of person hours went into producing the MNP

rebuttal presentation aimed at countering MNP’s recommendation to reduce the

size of the management team. This would only be possible if there was

sufficient surplus capacity in the Administration to work on this

presentation.

The reality is

that Owen Sound is the poorest municipality in the study group and cannot

afford the luxury of surplus capacity on our city staff. We need every

manager and every employee focused on delivering affordable services or

supporting those who do. Using scarce taxpayer resources to produce sales

and marketing materials that appear to be promoting a particular narrative

is not only wrong, but it’s something that the Owen Sound residents cannot

afford. Owen Sound’s Administration should follow the lead of the other

municipalities in the study group and just present Council with the facts

and let them make decisions in the absence of staff influence