Budget Process Improvements Ė Part I

On February 7th our city Council reviewed the 2023 budget

and for the first time in many years the budget increase was less than one

percent.† It was obvious to anyone reading the draft operating budget that this

year was very different from past years.† The budget presented by staff had a

very meager increase of only 0.56% during a time when inflation is running at

5-6%. This was a departure from past years where Council had to send back

budgets with increases of 2 to 3%.† This could not have happened without the

City Manager directing budget managers to sharpen their pencils. Itís important

for taxpayers to recognize the significance of this change in budget

preparations. Itís clear that the City Manager has heard our concerns and has

begun the process of reducing expenses. This change should be both recognized

and appreciated by all taxpayers.

On February 7th our city Council reviewed the 2023 budget

and for the first time in many years the budget increase was less than one

percent.† It was obvious to anyone reading the draft operating budget that this

year was very different from past years.† The budget presented by staff had a

very meager increase of only 0.56% during a time when inflation is running at

5-6%. This was a departure from past years where Council had to send back

budgets with increases of 2 to 3%.† This could not have happened without the

City Manager directing budget managers to sharpen their pencils. Itís important

for taxpayers to recognize the significance of this change in budget

preparations. Itís clear that the City Manager has heard our concerns and has

begun the process of reducing expenses. This change should be both recognized

and appreciated by all taxpayers.

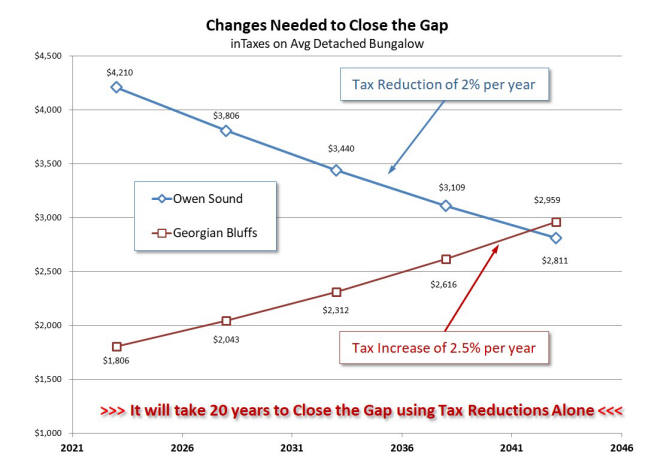

This year staff made Councilís job relatively easy and they readily approved an operating budget with an increase of less than one percent. However, as some members of council pointed out, there is still a significant gap between taxes in Owen Sound and taxes in our nearest neighbours in Georgian Bluffs.† The owner of an average detached bungalow in Georgian Bluffs currently pays $1,806 in taxes while an owner of the same property in Owen Sound pays $4,210. This is a huge gap that is stifling Owen Soundís growth and encouraging residents to move across the city boundary where they can save $2,404 per year in taxes while still enjoying everything that Owen Sound has to offer. Therefore there is much more to do to reduce this disparity.

Changing the Budget Process

If we are to make any significant inroads in achieving

property taxes that are competitive with our neighbours then we will have to

change the budget preparation process.† These changes should include tools such

as ďZero-Based BudgetingĒ that I recommended in my Road

to Recovery article. However the real change thatís needed is how the

budget is reviewed. This year our part-time council spent a little over six

hours reviewing the draft operating budget containing $39 million in spending.

Although Iím sure they each devoted much more than this in their preparation

for the review, six hours of formal review does not reflect the importance of a

$39 million budget.† For the most part they had to depend on an overview of the

budget presented by the Director of Corporate Services.† As the Director

correctly pointed out there was no time to go into a lot of detail at the

department level.

The Solution

What we need Council to do is to devote much more time to

the budget process. The review period should be two weeks and the process

should include the review of each and every department budget, line-by-line. To

enable this each member of council should be paid a full time salary, at the

city manager level, during which will likely be an intense two week budget review

process. This will cost taxpayers in the order of $60,000 to $70,000. However,

the return on this investment to taxpayers can be enormous.† This would allow members

of council to take a short leave of absence from their full time employment.†

In this process each budget manager would present their budget and have an

opportunity to fully justify each and every line item. Ideally, each budget

would start from a zero base as opposed to what was spent the previous year.

Closing the Gap

During the budget review process the Deputy Mayor

acknowledged that, although we made good progress in keeping the budget

increase to a minimum, we still had quite a way to go to eliminate the gap in taxes

between us and our surrounding municipalities.† There really is only one way of

closing the tax gap and that is to reduce expenses. This year we witnessed a

significant reduction in the annual tax increase, however it will take sixty

years to completely close the gap with Georgian Bluffs if we just keep tax

increases at less than one percent.† Closing the gap in our lifetime can only

be achieved with annual tax reductions combined with significant one-time expense reductions.

Figure 1;

Closing the Gap with Annual Tax Reductions

As shown in the graph above, if we were to have successive annual tax reductions of 2%, and Georgian Bluffs were to increase their taxes on average by 2.5%, it would take 20 years to completely close the gap. So in order to reduce the gap over a reasonable time period, it will also require one-time reductions in expenses, in addition to annual tax reductions.†

There are three areas that should be seriously considered for significant expense reductions. They are: the Art Gallery, the Transit System and the Workforce.† I will examine each of these for their potential in closing the tax gap.

Examining

the Art Gallery

With respect to the Art Gallery, Iíve mentioned in previous

papers that we learned in the community survey that the Art Gallery is valued

by less than 8% of the community. Their budget is $506,000 and has nearly

doubled over the past 5 years. The cost to taxpayers is currently $475,000

year. the survey also showed that 76% of the community either never or rarely

use this facility.

Last fall I sat down with the Director of Gallery to discuss the need to improve the Galleryís profile in the community.† I suggested that the Gallery needed to reach out, beyond the art community, by rolling out more community-based art education programs. I also suggested that regular presentations at our schools and college would vastly improve both community engagement and the value of the Gallery in the eyes of taxpayers. I also identified business graduate schools as a cost-free source of expertise to develop a new business plan and a revised community-focused marketing strategy.

I truly believe that implementing these suggestions could greatly improve the value of the Gallery in the eyes of the taxpayer. However, in the absence of a successful community engagement program, along with an education program that is highly valued by the community, the return on our annual $475,000 expenditure is just not justified.

Examining the Transit

In regard to public transit, in 2015 we paid $744,000 to provide transit services to a small portion of the population. Since then the number of people using transit has declined while the budget has nearly doubled.† Transit now costs us over $1.3 million per year to serve fewer people than we did in 2015.†

This service needs to either be significantly changed to reduce its burden on taxpayers, as I suggested in my article, How to Fix Our Broken Transit System, or it should be shuttered and current regular users added to the mobility transit service.† By doing, so regular users of the system, based on the historical purchase of transit passes, would benefit from improved service. However there would be a one-time cost for cancelling the current contract. In addition the cost of the mobility transit system would be significantly increased. Itís unclear what portion of the cost is associated with mobility transit. Assuming itís in the order of 20% that would leave a potential annual savings of about $800,000 per year if the regular service was cancelled after the one-time contract cancellation cost.

In Part II we will examine the potential for the workforce as a source of savings. I will also identify exactly what the problem is when it comes to workforce size at the city and provide clear suggestions for Council on how they can deal with this problem this year, as opposed to putting it off as many previous Councils have in the past.