A Solution to House ALL Owen Sound Residents

The solution to end homelessness can be found in my last study comparing Owen Sound to 12 other municipalities. Essentially what I concluded from doing this research is that Owen Sound's expenses are at a minimum $5.0 million more than similarly sized municipalities and likely as high as $10.0 million. It appears city hall is overstaffed. Realizable reductions in expenses can be achieved within a year by applying sound change management and financial management techniques. This will immediately free up at a minimum $5 million and possibly up to $10.that can be reassigned to roll out a Housing First Program. My complete conclusions and recommendations are below.

|

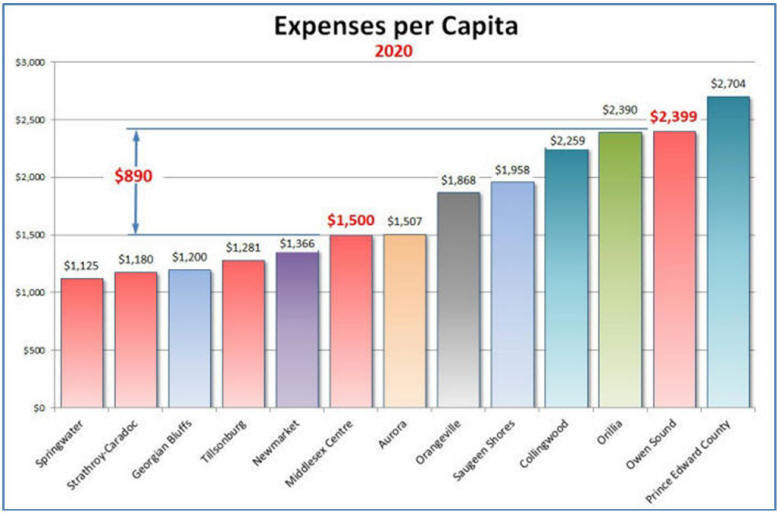

| Figure 7; Total Expenses per Capita source: Audited Financial Statements the Municipal websites |

Figure 7, shows total expenses per capita. When we look at our

Primary Comparative Group, as shown with red lettering, we see that

Owen Sound once again leads this group by significant margins. We

see that Strathroy is quite a bit lower than Owen Sound in total

expenses. However, Middlesex Centre is the closest this time with

expenses per capita of $1,500 compared to Owen Sound at $2,399.

Although it does look like much, the difference of $890 per resident

is a huge sum. When you multiply this by Owen Soundís population it

works out to be a difference in expenses to run the city of $19

million. Middlesex does have a slightly smaller population so it

could be that they do not provide the same level of services that

Owen Sound provided its residents.

This supports the data from the previous two sources and removes the

uncertainty of contracted out services. It makes it clear that one

of the reasons that Owen Sound needs higher taxes is to support the

abnormally high expenses as compared to Strathroy, Middlesex,

Tillsonburg and Springwater. Again, the reason for this could be

that these municipalities are providing fewer services; hence, it

costs less to run their municipalities. The only way to know for

sure is to do a detailed service comparison with all four of these

municipalities. If they are providing the same services, at the same

level, whether contracted or not, then the solution is simple,

reduce Owen Soundís expenses to match theirs. As we saw above this

will likely require a reduction in the workforce.

When we look at what the Sunshine List is costing us each year, beyond what Strathroy-Caradoc pays, it becomes clear why our Salaries and Benefits expense is so high as compared to Strathroy. Owen Sound pays nearly $4.9 million more on Sunshine List salaries than Strathroy-Caradoc. This suggests that senior staff salaries have grown well beyond the cityís growth? This didnít happen overnight. I suspect that it occurred over a twenty (20) year period with annual incremental changes that would go unnoticed in any particular budget year. Regardless of how we got here, it appears that the city has an overabundance of senior staff in comparison to Strathroy. Council owes it to taxpayers to fully investigate this disparity and direct the changes necessary to right-size management staff. However, given the magnitude of this disparity, it will take a few years to correct this apparent imbalance.

In Part I of

Comparing Owen Sound Employees, under the Expenses Tab, we saw

that Owen Soundís Salaries and Benefits Expense was, at a minimum,

$11.6 million more than what it

should be based a comparison with Strathroy. In Part II of

Comparing Owen Sound Employees, we learned that Owen Sound has

73 senior staff earning $100,000 or more, while the closest

municipality to Owen Sound in the study, Strathroy, has only 34

senior staff on this List. That tells us that Owen Sound could save

at least $5,0 million each and

every year if it just matched Strathroyís numbers on the Sunshine

List.

There is no question that over the years successive councils have

allowed expenses in general to increase each year. From the relative

difference between Owen Sound and Strathroy, in Salaries and

Benefits Expense it clear that Owen Soundís Expenses are abnormally

high.

The Facts

|

|

|

|

|

|

In summary, it is clear to me that Owen Sound has expenses that, at a minimum, are $5 million more than they really need to be. On a positive note, a portion of the annual savings that will materialize from expense reductions should be directed to address our growing social problems. We currently have a very serious problem in our community where some of our residents are living in tents and sleeping in the streets. We saw that Owen Sound spends in the order of $12 million more on salaries and benefits than Strathroy. If Council were to begin to practice sound financial management and reduce expenses, by at least $10 million, to be close to Strathroyís, we could provide housing for the 50 plus unhoused residents in Owen and at the same time have enough left over to give taxpayers an immediate 10% reduction in taxes as well as freeze taxes for the next five (5) years.

The feedback I received when offering solutions, to mitigate the

pain felt by these residents, was that this is a ďCounty ProblemĒ. I

disagree with this analysis. Although the County is attempting to

address this issue for all municipalities in the County, it is a

City of Owen Sound Problem and Iíve just given you the solution.