|

2024 Taxes Bruce Grey Municipalities |

|

|

|

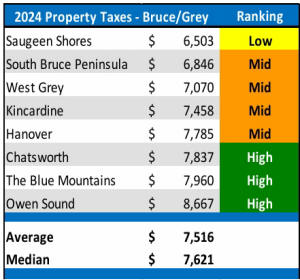

Senior Executive 15.3% higher than average |

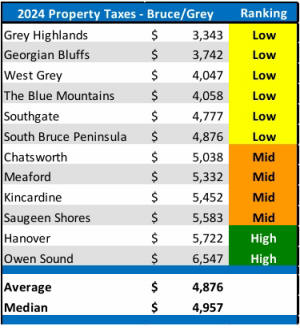

Two-Story Home 34.3% higher than average |

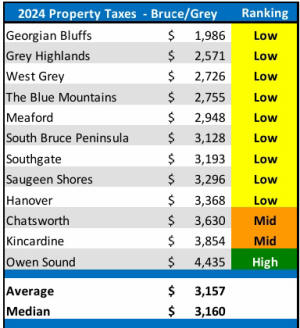

Detached Bungalow 40.5% higher than average |

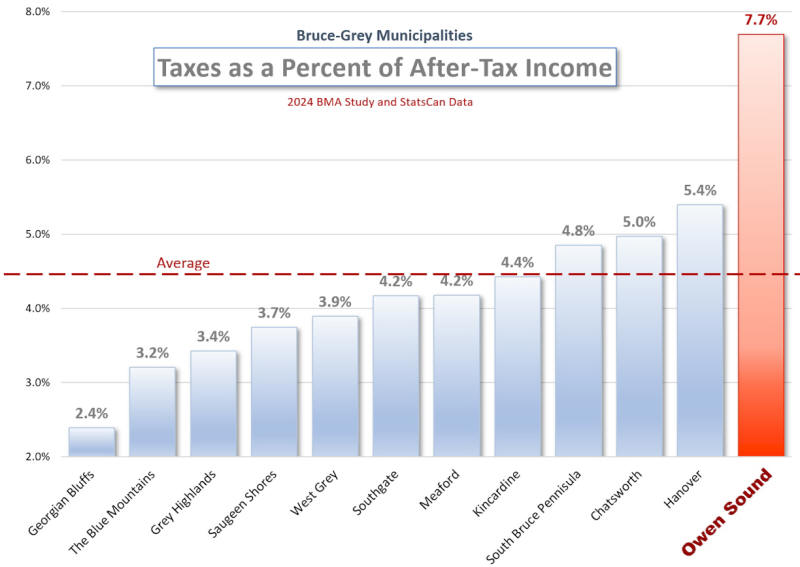

As shown in the above charts which are taken from the 2024 BMA Report. Owen Sound has by far the highest taxes in Bruce-Grey (at least those Bruce-Grey municipalities that subscribe to BMA Reports). As shown in red below each chart Owen Sound taxes are significantly higher than the average - as much as 49.5% for a single detached Bungalow. And when you compare Owen Sound taxes to our nearest neighbour, Georgian Bluffs, we see that Owen Sound taxes are 123% higher than Georgian Bluffs. This means that taxpayers in Georgian Bluff pay less than half of what taxpayers in Owen Sound pay for a similar detached bungalow. Yet, their proximity to Owen Sound means that Georgian Bluffs' taxpayers can enjoy all of the parks and recreational facilities that Owen Sound taxpayers provide.

Ability to Pay Taxes

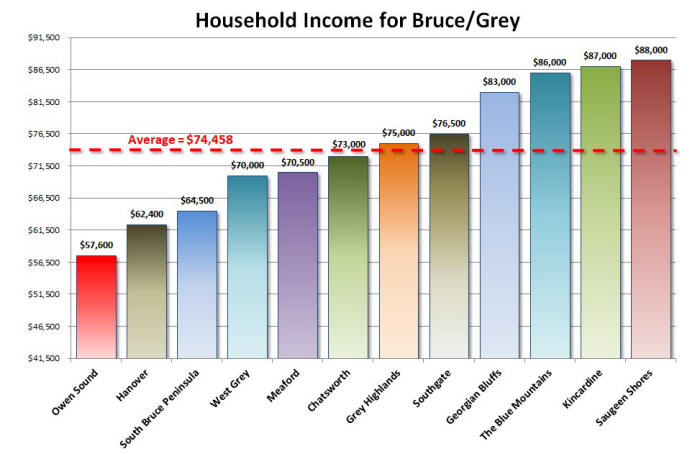

To date the ability for residents to fund municipal operations has not been a consideration when setting the annual budget. Owen Sound 's residents are the poorest among the comparators. Owen Sound 's median household income of only $57.600 as shown below. Median is defined as the Middle value separating the greater and lesser halves of a data set, i.e. half our population is living on less than $57,000 per household. Although most of these households are renters, landlords pass on their tax expense to their tenants in higher rents.

|

| Median After-Tax, Household Income Comparison Source: Statistics Canada |

As you can see Owen Sound 's median after-tax household income of $57,600 is much lower than the Grey/Bruce Counties average of $74,458. What 's interesting in this chart is how Owen Sound compares to its closest neighbours, Meaford and Georgian Bluffs. As you can see our neighbours to the west in Georgian Bluffs are quite wealthy compared to us with a median after-tax household income of $83,000. Meaford with a household income of $70,500 is also doing quite well in comparison with Owen Sound, as is Chatsworth at $73,000. It seems like we are surrounded by relative wealthy neighbours. Perhaps we should ask all of them to help us out with the cost of the regional services we provide them such as the Harry Lumley Bayshore Community Center, the Julie Macarthur Recreation Center and the Tom Thomson Art Gallery.

The Impact of Taxes Changes with Municipality

When it comes to taxes it’s not all about ‘tax-rates’. It comes down what you have left of your pay cheque to give the city after the other levels of government take their share. If you live in Owen Sound it’s highly probable that your pay cheque is smaller than it would be if you lived in Kincardine for example, so taxes take a much bigger bite out of your smaller pay cheque. Therefore when the mayor claims that the city is doing well when it comes to taxes, he is not considering your ability to pay.

To get a good understanding of where Owen Sound stands when it comes to taxes you must consider Taxes as a Percentage of After-Tax Household Income as shown below.

|

| Taxes as a Percentage of Median After-Tax Household Income |

The Bottom Line

Owen Sound's High Taxes present a huge burden to residents - whether you own

your home or your renting, you Owen Sound's failure to be fiscally

responsible is hurting. to I have over 30 years of experience managing public sector

administrations in both federal and provincial environments. What I 've

learned over the years is that in traditional public sector administrations

managers sometimes have their own informal organizational goals that are

often in conflict with the organization 's formal leadership. If one of those

goals is to expand the size of the empire, regardless of any ‘real '

additional work – given that the population is stagnant hence service demand

is flat – you will see an attempt to leverage any perceived new demand to

argue for an increase in expenses or staffing. Here is just a small example

of how staff is able to persuade Committees to increase expenses and expand

the workforce.